In the fast-evolving landscape of finance, technological advancements have ushered in an era of unprecedented change. Hyperautomation, a concept combining advanced technologies such as Artificial Intelligence (AI), Machine Learning (ML), Robotic Process Automation (RPA), and analytics, has emerged as a transformative force. This article delves deep into the realm of hyperautomation in finance, exploring how it enhances security, ensures compliance, and revolutionizes traditional financial processes.

Understanding Hyperautomation in Finance

Hyperautomation is an advanced technology-driven approach that aims to automate and optimize various business processes, combining several emerging technologies such as Artificial Intelligence (AI), Machine Learning (ML), Robotic Process Automation (RPA), data analytics, and more. In the financial sector, hyperautomation is transforming traditional processes, offering increased efficiency, enhanced accuracy, improved compliance, and a better customer experience.

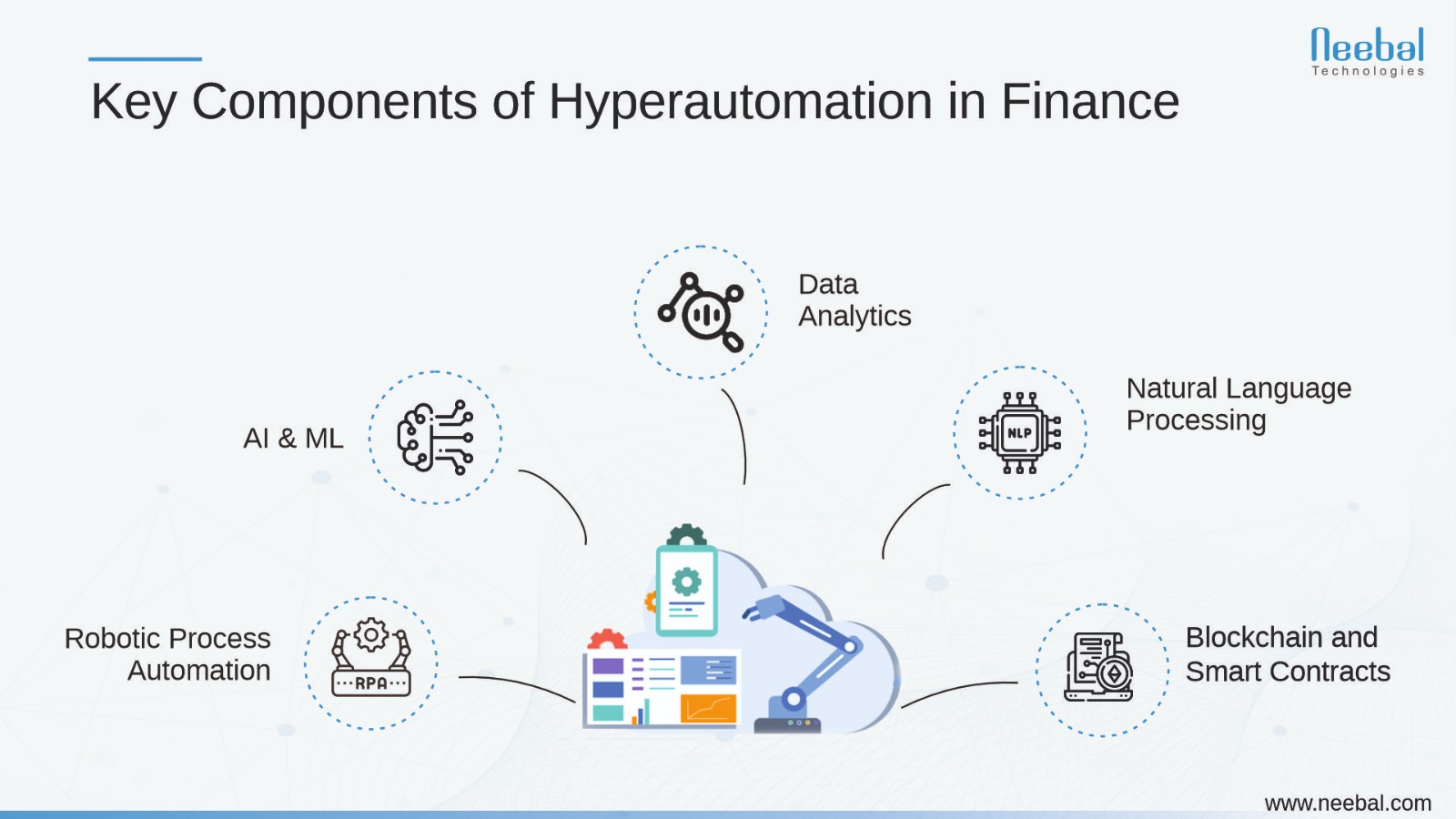

Key Components of Hyperautomation in Finance

- Robotic Process Automation (RPA): RPA involves the use of software robots or bots to perform repetitive and rule-based tasks, such as data entry, transaction processing, and reconciliation. In finance, RPA can automate tasks like invoice processing, account reconciliation, and data extraction from financial statements.

- Artificial Intelligence (AI) and Machine Learning (ML): AI and ML enable machines to learn from data, recognize patterns, and make decisions. In finance, AI-powered algorithms are used for credit scoring, fraud detection, chatbots for customer service, and personal financial advice.

- Data Analytics: Data analytics tools are essential for making sense of vast financial data. These tools can provide insights into market trends, customer behavior, and investment opportunities. They are crucial for portfolio management, risk assessment, and fraud detection.

- Natural Language Processing (NLP): NLP technology allows machines to understand and interact with human language. In finance, NLP is used for sentiment analysis of news and social media to make investment decisions or for chatbots that can understand customer queries and responses in natural language.

- Blockchain and Smart Contracts: Blockchain technology ensures secure, transparent, and tamper-proof financial transactions. Smart contracts, built on blockchain, automate the execution of predefined contract terms, such as interest payments, insurance claims, and trade settlements.

Examples of Hyperautomation in Finance

- Algorithmic Trading: Investment banks and hedge funds use AI and ML algorithms to make high-frequency trading decisions. These algorithms analyze market data in real-time to identify trading opportunities and execute orders with minimal human intervention.

- Credit Scoring: Traditional credit scoring models are enhanced by AI-driven algorithms that consider a wider range of data, such as social media behavior and online shopping habits. This results in more accurate and fair credit assessments.

- Chatbots for Customer Support: Many financial institutions deploy chatbots that use NLP to interact with customers. These chatbots can handle routine customer queries, provide account information, and even assist in completing applications for financial products.

- Fraud Detection: AI and ML are employed to detect fraudulent transactions by analyzing large volumes of data and identifying suspicious patterns. Financial institutions can act quickly to prevent or mitigate fraud.

- Regulatory Compliance: Compliance departments use RPA to automate the extraction of data and the preparation of reports for regulatory authorities. This reduces the risk of errors and ensures that institutions meet their compliance requirements.

- Personalized Investment Advice: Some financial advisory firms use AI to provide personalized investment advice. Based on a client’s financial goals, risk tolerance, and market conditions, these systems suggest customized investment strategies.

- Claims Processing: Insurance companies use RPA to expedite claims processing. The technology can verify the authenticity of claims, calculate payouts, and issue payments quickly.

Enhancing Security through Hyperautomation

- Fraud Detection and Prevention: Hyperautomation algorithms analyze vast datasets in real-time, identifying patterns indicative of fraudulent activities. By detecting anomalies and triggering alerts, financial institutions can prevent fraud before it occurs.

- Identity Verification: AI-powered biometric recognition and document verification tools enhance identity verification processes. These technologies ensure that only authorized individuals access sensitive financial information.

- Data Encryption and Privacy: Hyperautomation systems incorporate robust encryption methods, safeguarding data from unauthorized access. Compliance with data protection regulations such as GDPR is ensured, bolstering customer trust.

- Cybersecurity Measures: AI-driven cybersecurity tools can predict and counter cyber threats in real-time, preventing data breaches and ensuring the integrity of financial transactions.Achieving Compliance with Hyperautomation

- Regulatory Reporting Automation: Hyperautomation enables real-time monitoring of transactions, ensuring compliance with regulatory requirements. Automated reporting tools generate accurate and timely reports, reducing the risk of non-compliance penalties.

- Anti-Money Laundering (AML) and Know Your Customer (KYC) Compliance: Automated AML and KYC processes utilize AI algorithms to analyze vast datasets, quickly identifying suspicious transactions or customers. This ensures compliance with regulations and prevents financial crimes.

- Audit Trail and Transparency: Hyperautomation creates detailed audit trails for all financial activities. This transparency ensures that all transactions are traceable, providing an additional layer of compliance and security.

Revolutionizing Traditional Financial Processes

- Efficient Loan Processing: Hyperautomation accelerates loan processing by automating credit checks, document verification, and risk assessment. This reduces the processing time, providing customers with quicker decisions.

- Automated Customer Support: Chatbots and virtual assistants powered by hyperautomation provide instant customer support. They can handle routine queries, account inquiries, and even guide customers through financial processes, enhancing customer satisfaction.

- Predictive Analytics for Investment: By analyzing historical data and market trends, hyperautomation tools provide predictive analytics. Financial institutions can make informed investment decisions, mitigating risks and maximizing returns.

Conclusion

Hyperautomation in finance is not merely a technological advancement; it’s a strategic imperative. By enhancing security, ensuring compliance, and revolutionizing traditional financial processes, hyperautomation empowers financial institutions to thrive in the digital age. As the finance industry continues to evolve, embracing hyperautomation is not just an option; it’s a necessity for staying competitive, secure, and compliant. The synergy of human expertise and technological innovation in hyperautomation paves the way for a more efficient, secure, and customer-focused financial landscape.

Topics: Technology, Blockchain, Cyber Security, RPA Solutions, Hyperautomation, DevOps, AI