Making smart decisions is more challenging than ever. The global financial markets are intricate, and decision-making involves handling massive amounts of data. Traditional methods of manual analysis are not only time-consuming but also prone to inaccuracies. This is where Artificial Intelligence (AI) steps in, revolutionizing the financial sector. Let’s dive into the realm of predictive and prescriptive analytics, two powerful tools shaping the future of financial decision-making.

Understanding the Complexity

Decisions in finance are no longer as simple as they used to be. The complexity of global financial markets demands advanced strategies. The sheer volume of data involved in every business aspect makes decision-making complicated. Manually sifting through enormous datasets is not only costly but also prone to errors. Here’s where the financial sector turns to AI-backed analytics for better, faster, and data-driven decision-making.

The Rise of AI in Finance

According to the Mordor Intelligence Report, the demand for Machine Learning (ML) and AI in the financial technology (fintech) sector alone is projected to reach $26.67 billion by 2026. AI is finding applications across various domains, with a significant impact on data collection and analysis.

Predictive Analytics Unveiled

Predictive analytics, with a projected market growth of $41.52 billion by 2028, is a powerhouse in deciphering vast datasets. This tool utilizes machine learning and artificial intelligence to analyze past data, unveiling patterns, relationships, and trends that help predict future outcomes. For instance, a financial services firm might use predictive analytics to forecast risk levels or assess the likelihood of loan defaults based on a customer’s past financial behavior.

Standard ML and AI techniques, such as regression analysis and random forest, play vital roles in predictive analytics.

The speed and accuracy of predictive analytics have advanced significantly, allowing financial institutions to expand their implementation across strategic and tactical areas of their business.

Prescriptive Analytics Decoded

Prescriptive analytics, expected to grow by 24% from $4.9 billion in 2021 to $14.3 billion by 2026, proposes action plans or strategies based on data regarding potential situations, available resources, and past and present performance. It integrates predictive, descriptive, and diagnostic analytics to provide decision-makers with actionable insights. This enables them to make decisions based on statistically sound data and models.

For instance, a financial services firm might use prescriptive analytics to determine the investments most likely to yield the highest returns. Machine learning and AI are pivotal components of prescriptive analytics, enabling systems to learn from data and improve predictions over time. Techniques such as neural networks and decision trees contribute to creating models that predict future outcomes based on historical data.

The Synergy of Predictive and Prescriptive Analytics

The combination of predictive and prescriptive analytics is a game-changer in financial decision-making. Predictive analytics identifies trends or patterns in data, while prescriptive analytics determines the best course of action in a given situation. Financial firms, by leveraging both forms of analytics, can make more informed decisions and assess risks more accurately.

These methods find applications in portfolio management, asset allocation, credit risk assessment, and customer segmentation. For example, predictive analytics may forecast the future credit risk of a customer segment, and prescriptive analytics can then determine the best strategies to mitigate that risk.

Prescriptive Analytics Decoded

Prescriptive analytics, expected to grow multi-folds by 2026, proposes action plans or strategies based on data regarding potential situations, available resources, and past and present performance. It integrates predictive, descriptive, and diagnostic analytics to provide decision-makers with actionable insights. This enables them to make decisions based on statistically sound data and models.

The Dynamics of Prescriptive Analytics Techniques

Machine learning and AI are important components of prescriptive analytics, enabling systems to learn from data and improve predictions over time. Techniques such as neural networks and decision trees contribute to creating models that predict future outcomes based on historical data.

The Synergy of Predictive and Prescriptive Analytics

The combination of predictive and prescriptive analytics is a game-changer in financial decision-making. Predictive analytics identifies trends or patterns in data, while prescriptive analytics determines the best course of action in a given situation. Financial firms, by leveraging both forms of analytics, can make more informed decisions and assess risks more accurately.

Applications Across Financial Sectors

These analytics methods find applications in portfolio management, asset allocation, credit risk assessment, and customer segmentation. For example, predictive analytics may forecast the future credit risk of a customer segment, and prescriptive analytics can then determine the best strategies to mitigate that risk.

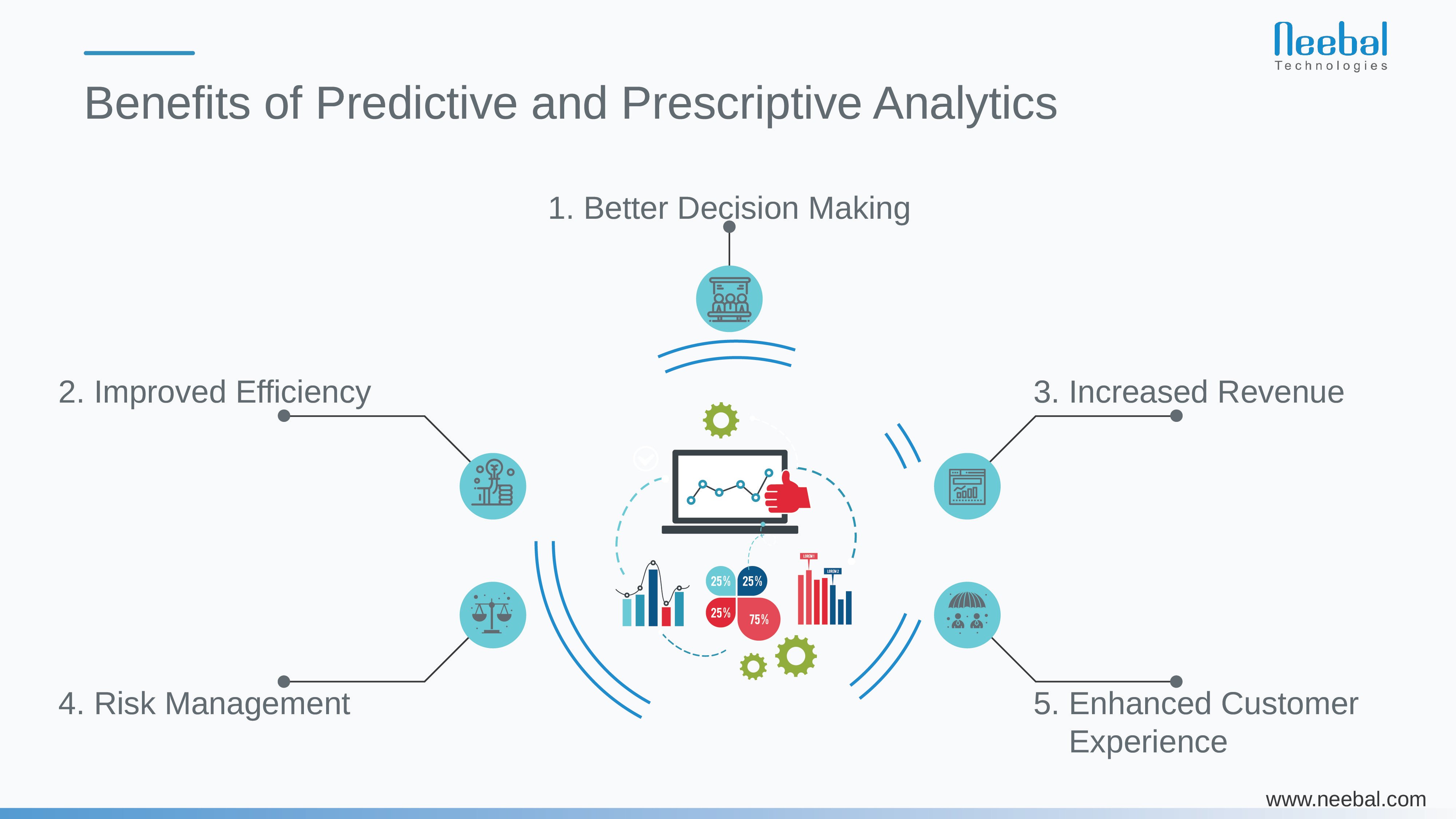

Benefits of Predictive and Prescriptive Analytics

- Better Decision Making : Predictive analytics forecasts future events and identifies potential risks. Prescriptive analytics advises on the best course of action to take.

By combining both, financial institutions make more informed decisions based on data-driven insights. - Improved Efficiency : Predictive and prescriptive analytics automate decision-making processes. This reduces manual workloads and improves operational efficiency, saving time and money.

- Increased Revenue : By analyzing customer behavior, predictive and prescriptive analytics help identify new revenue opportunities. Tailoring products and services to meet customer needs enhances customer loyalty and lifetime value.

- Risk Management: Predictive and prescriptive analytics identify potential risks and recommend mitigation strategies. This reduces losses and protects the institution’s reputation for all stakeholders.

- Enhanced Customer Experience: Predictive and prescriptive analytics help institutions understand customers better. Tailoring offerings to individual preferences results in more satisfied and loyal customers.

Conclusion

Staying ahead requires harnessing the power of predictive and prescriptive analytics. Machine learning and AI algorithms, by analyzing data and providing recommendations, give financial institutions a competitive advantage. These tools not only streamline decision-making processes but also enhance customer experiences. As predictive and prescriptive analytics continue to evolve, financial institutions embracing these technologies are poised to shape a more efficient, profitable, and customer-centric future.

Neebal empowers financial decision-makers with cutting-edge predictive analytics services. Leveraging advanced algorithms and machine learning, Neebal’s solutions analyze historical data to unveil trends, forecast risks, and optimize strategies. With Neebal, clients gain a competitive edge by making well-informed decisions that drive efficiency, minimize risks, and maximize financial success.

Topics: technologies, Technology, IoT Solutions, AI