Banks are leading the way in using new and smart solutions to make customer service even better. One big game-changer in this tech revolution is AI chatbots. These digital helpers are shaking up how banks talk to their customers. Let’s dive into the amazing journey of how AI chatbots are making customer service exceptional in the lively world of finance.

These days, banks are all about finding better ways to help their customers. Among the cool new things they’re trying out, AI chatbots are standing out. These digital assistants are like superheroes, changing how banks connect with the people they serve. This article will explore the exciting path these chatbots are paving, making customer service in finance something truly special.

Streamlined Customer Interactions

AI chatbots usher in a new era of efficiency in customer interactions. With their advanced natural language processing capabilities, these virtual assistants engage in real-time conversations, promptly addressing customer queries and concerns.

The result is a significant reduction in waiting times, expedited issue resolution, and ultimately, a notable improvement in customer satisfaction. The seamless and instantaneous nature of these interactions transforms the way financial institutions engage with their clients, fostering a more responsive and customer-centric approach.

24/7 Availability

Breaking free from the constraints of traditional business hours, AI chatbots provide unparalleled availability. Financial institutions are no longer bound by strict schedules, as chatbots stand ready to handle customer inquiries at any time of the day or night.

This constant availability ensures that customers can receive assistance and support whenever they need it, significantly enhancing their overall experience and trust in the institution. The round-the-clock service aligns with the modern customer’s expectations for instant access to information and assistance, contributing to a more agile and responsive financial service ecosystem.

Personalized and Tailored Assistance

One of the most significant advantages of AI chatbots is their capability to deliver personalized and tailored assistance to customers. Leveraging machine learning algorithms, chatbots analyze customer data, transaction history, and preferences to provide relevant and customized recommendations.

This level of personalization goes beyond a one-size-fits-all approach, helping financial institutions create a more engaging and individualized customer experience. The ability to offer tailored assistance contributes to building stronger relationships, fostering customer loyalty, and positioning the institution as a trusted financial partner in the eyes of the clients.

Enhanced Security

Security is paramount in the financial industry, and AI chatbots play a crucial role in ensuring the protection of customer data. These virtual assistants can authenticate customers, verify identities, and handle sensitive information securely. By adhering to strict security protocols, AI chatbots instill confidence in customers, assuring them that their financial information is safe and well-guarded.

This enhanced security not only meets regulatory requirements but also addresses a critical aspect of customer trust in financial institutions. The robust security measures implemented by chatbots contribute to creating a secure and reliable digital environment for customers to conduct their financial transactions.

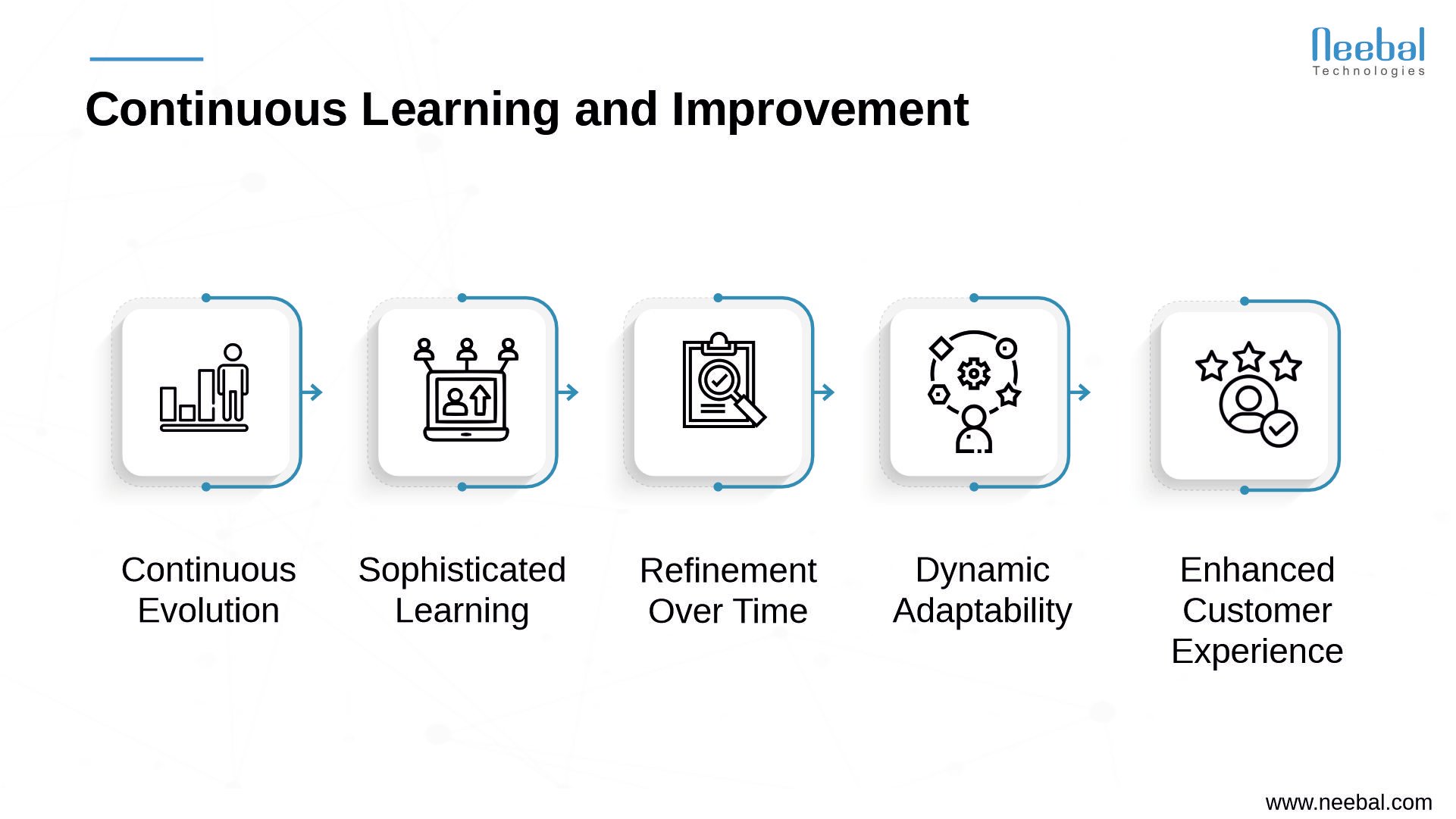

Continuous Learning and Improvement

- AI chatbots keep evolving after setup.

- They learn and adapt from ongoing interactions.

- Using advanced machine learning techniques.

- Analyzing past conversations to identify patterns.

- The iterative learning process refines responses.

- Ensures chatbots provide more accurate information.

- Showcase dynamic adaptability to changing needs.

- Learn and adjust from real-world interactions.

- Results in a continually improving service experience.

- Chatbots become dynamic tools in finance.

A Personal Touch in Every Interaction

AI chatbots bring a personal touch to customer interactions, making every conversation feel tailored to the individual. These digital assistants are like friendly guides, understanding customer needs and preferences. Whether it’s answering questions or helping with transactions, AI chatbots create a warm and personalized experience. This personal touch goes a long way in building trust and making customers feel valued.

Speedy Solutions for Quick Satisfaction

One standout feature of AI chatbots is their lightning-fast responses. No more waiting on hold or delayed replies. Chatbots provide instant solutions, addressing customer queries in the blink of an eye. This speed not only saves time but also ensures customers leave with a smile. The efficiency of AI chatbots in delivering quick and accurate information contributes significantly to a positive customer service experience.

Learning from Every Interaction for Smarter Service

AI chatbots are like super-smart learners, getting better with each conversation. They analyze past interactions, learn from them, and adapt their responses accordingly. This continuous learning process means that over time, chatbots become even more intelligent and efficient. It’s like having a virtual assistant that not only helps now but gets better at helping as time goes on.

Round-the-Clock Assistance, Anytime, Anywhere

Imagine having a helpful friend available 24/7. AI chatbots provide just that. Whether it’s the middle of the night or during a hectic workday, these digital assistants are always ready to assist. This constant availability ensures that customers can get the help they need at any time, adding a layer of convenience and reliability to the banking experience.

Building Confidence Through Secure Conversations

Security is non-negotiable. AI chatbots play a vital role in ensuring secure customer interactions. From verifying identities to handling sensitive information, these digital assistants follow strict security protocols. This not only protects customer data but also builds confidence. Knowing that their information is safe and handled with care adds an extra layer of trust between customers and their bank

Conclusion

AI chatbots and virtual assistants are not merely technological trends but rather catalysts for a customer service revolution in the finance industry. The streamlined interactions, round-the-clock availability, personalized assistance, enhanced security measures, and continuous learning capabilities redefine the customer experience in financial institutions.

As we embrace these transformative technologies, the future of customer service in finance appears more engaging, efficient, and customer-centric than ever before, marking a new era in the intersection of finance and technology.

Neebal stands out in transforming financial customer service with advanced Chatbots and Virtual Assistants. Our solutions give a personal touch, quick responses, and learn from every interaction. We’re available 24/7, ensuring secure conversations for trust. Choose Neebal for a smarter and more customer-friendly financial experience.

Topics: Technology, IoT Solutions, AI