Financial technology, or FinTech, artificial intelligence (AI), and machine learning (ML) have emerged as transformative forces. Approximately 85% of FinTech companies have embraced these technologies to enhance financial software, ensuring high-quality and secure services for users. In this blog, we’ll explore key AI and ML use cases in FinTech and delve into the significant benefits they bring to the industry.

Analytics and Forecasting in FinTech

One of the primary applications of AI and ML in FinTech is analytics and forecasting. Around 43% of financial services companies use ML algorithms for advanced data analytics. These solutions empower users to make accurate predictions and complex calculations, reducing human error. For instance, American Express leveraged ML algorithms to cut potential credit assessment time from 30 days to mere minutes, boosting decision-making by 20-30%. From credit scoring to insurance and payment recommendations, AI-driven analytics enhances financial decision-making and saves resources.

Security and Risk Management

Approximately 56% of FinTech companies utilize AI for risk management, a critical aspect of financial services. AI algorithms analyze historical data to identify potential risks, such as fraudulent behavior, money laundering, credit card fraud, and identity theft. Anti-money laundering efforts benefit significantly from AI, enabling the detection of complex schemes that traditional systems might miss. Notably, AI enhances security measures, providing a robust defense against cybercrimes and ensuring the integrity of financial transactions.

Robotic Process Automation (RPA)

RPA involves deploying AI assistants to automate repetitive tasks traditionally handled by humans. This includes tasks like data entry, document verification, loan processing, and report generation. By implementing RPA, financial institutions streamline operations, reduce processing time, and minimize errors. Zurich Insurance, for example, achieved significant efficiency gains by automating data entry and validation, showcasing the tangible impact of RPA on operational excellence.

Chatbots and Virtual Assistants

AI-driven chatbots and virtual assistants play a pivotal role in enhancing customer service in the FinTech industry. According to user satisfaction surveys, 71% believe AI improves customer service. These virtual assistants offer instant responses, guiding users through various financial processes and providing 24/7 support. Capital One’s virtual assistant, Eno, exemplifies this by significantly improving customer service through solutions ranging from account checking to balance monitoring.

Personalized Recommendations

AI excels at providing personalized recommendations by analyzing consumer data and behavioral patterns. From investment recommendations to product suggestions and budgeting assistance, AI-powered systems enable tailored financial advice. Apps like Wally automatically track and analyze financial data, offering personalized recommendations for budgeting and financial planning. These personalized services enhance customer loyalty and contribute to overall business success.

Algorithmic Trading

Algorithmic trading, a rapidly emerging field, leverages AI and ML for executing stock trades based on pre-programmed instructions. With an estimated market size of $41.9 billion by 2030, algorithmic trading platforms analyze market data, identify trading patterns, and execute trades at optimal prices. Renaissance Technologies, a successful example, generates impressive annual returns of about 66% by employing AI-driven trading techniques supported by data analysis and mathematical models.

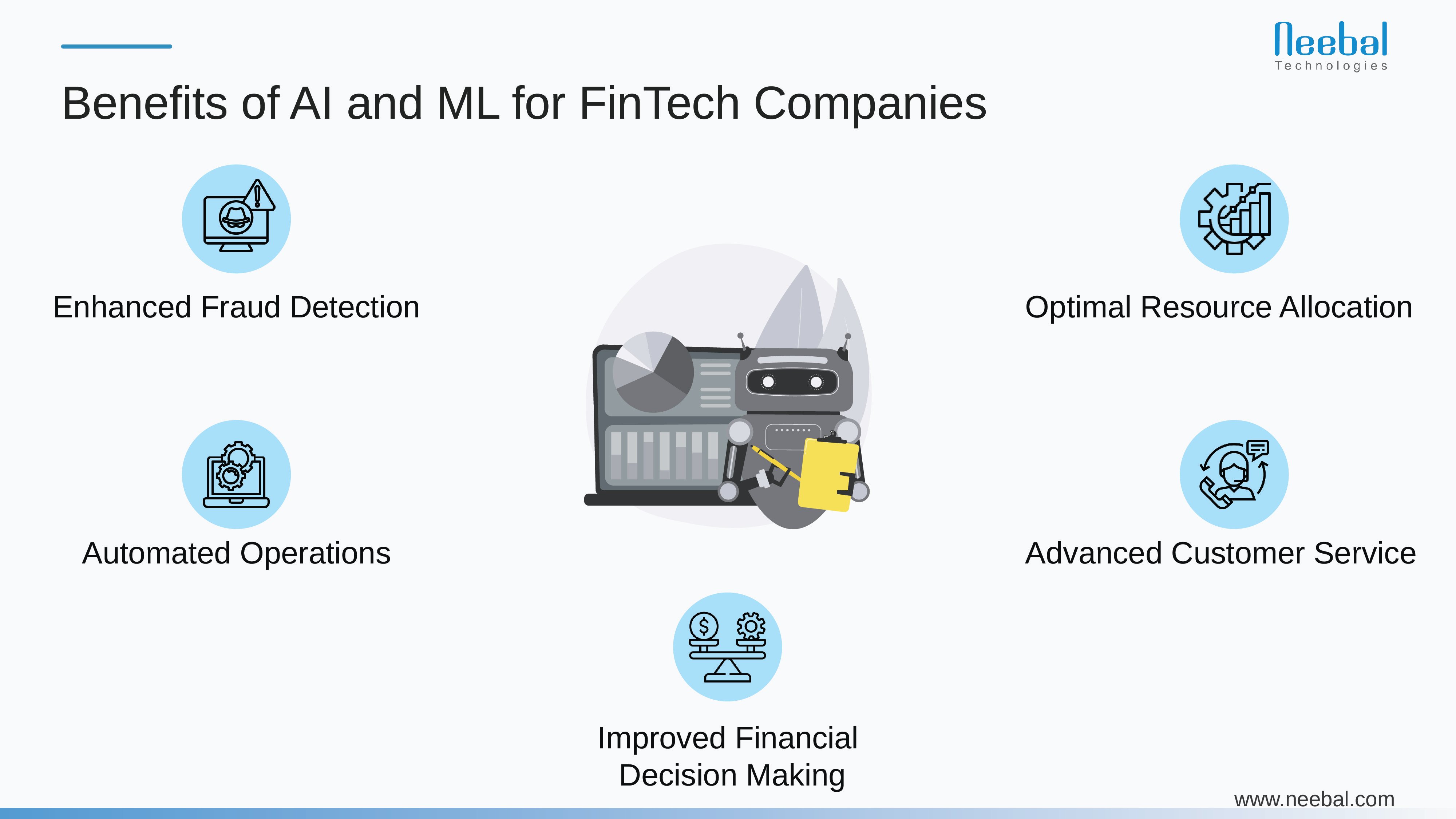

Benefits of AI and ML for FinTech Companies

1. Enhanced Fraud Detection

Implementing AI for fraud detection significantly enhances security measures, reducing fraud losses in areas such as payments, transactions, and account activities. AI fraud detection systems analyze data from various sources, including transactional data, customer profiles, and social media, to identify potential fraud indicators. By considering a wide range of data points, AI algorithms uncover hidden correlations, improving the accuracy of fraud detection.

2. Automated Operations

Machine Learning simplifies banking procedures, generates forecasts, and automates document processing. Automating back-office tasks through AI not only increases efficiency but also frees up time for more critical aspects of the job. Financial institutions can eliminate manual data entry, verify information, and generate forecasts with greater accuracy by leveraging AI automation.

3. Advanced Customer Service

AI-powered customer service enhances the overall customer experience by analyzing data, transaction history, and client behavior. This enables the delivery of personalized services, tailored product recommendations, and customized financial advice. With AI, financial institutions can provide faster responses, 24-hour live chat support, and multilingual assistance, contributing to increased customer satisfaction.

4. Improved Financial Decision Making

AI’s ability to identify non-obvious relationships between data significantly improves decision-making processes. By simulating ‘what-if’ scenarios, providing data-driven risk strategies, and offering real-time perspectives, AI empowers financial institutions to make informed decisions. Detecting unusual transactions and market fluctuations allows for prompt adjustments to financial strategies when needed.

5. Optimal Resource Allocation

AI models analyze market data, historical performance, and risk factors to identify the most optimal asset allocation within investment options. This ensures a balanced approach to risk and return, maximizing the efficient use of available resources. Additionally, AI enables targeted resource deployment, such as personalized marketing campaigns and individualized customer care, based on customer segmentation.

Conclusion

The integration of AI and ML technologies into FinTech has revolutionized the industry. From analytics and forecasting to security, automation, customer service, and decision-making, the benefits are many. Financial institutions leveraging these technologies stand to gain enhanced fraud detection, streamlined operations, improved customer service, better decision-making capabilities, and optimal resource allocation. As FinTech continues to evolve, embracing AI and ML will be crucial for staying competitive and providing innovative, secure, and efficient financial services

Neebal, a leading provider of AI-driven fintech solutions, prioritizes data privacy and security. Our services are designed with a strong commitment to safeguarding user information. We employ advanced encryption methods and adhere to data protection protocols to ensure the confidentiality and integrity of financial data. Neebal recognizes the critical importance of maintaining trust in the rapidly evolving landscape of fintech. By implementing robust security measures, we empower our clients with the confidence that their sensitive financial information is handled with the utmost care and in compliance with the highest standards of data privacy.

Topics: technologies, Technology, IoT Solutions, AI